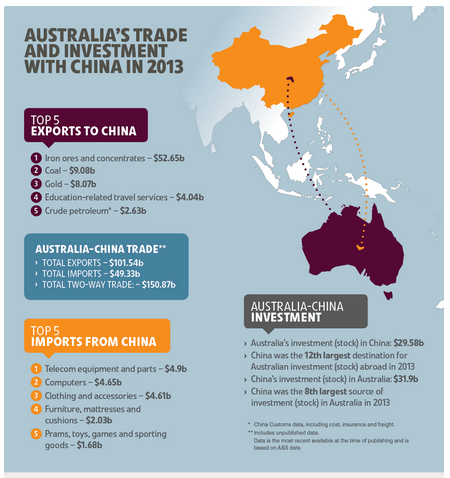

Tony Abbott announced the completion of negotiations for a China – Australia Free Trade Agreement (ChAFTA) in Canberra this morning. Australia and China have been in negotiations on the agreement since 2005 and it includes a complex series of agreements on everything from agricultural tariffs to quotas, manufactured goods, services and investment. China is already Australia’s largest trading partner, with two-way trade worth around $150 billion each year. In agriculture, the big winners in the FTA look to be red meat, fruit and vegetables, seafood, wine and dairy products. Sugar and rice producers are likely to be less well accommodated.

Key Points for Food Manufacturers:

- China’s demand for high-quality beef is growing rapidly, driven by a growing middle class. The OECD assesses that beef will be the fastest-growing import sector in China. Tariffs of 12 to 25 percent on beef will be removed over nine years.

- Crucially, New Zealand’s FTA with China contains restrictive safeguard measures on a wide range of dairy products, including liquid milk, cheese, butter and all milk powders (where China raises the tariff back to the normal rate when New Zealand exports exceed a certain volume). In contrast, under ChAFTA Australia will only face a discretionary safeguard on whole milk powders, with the safeguard trigger volume set well above current trade levels and indexed to grow annually. For all other dairy products Australia will receive unlimited preferential access. Tariffs on all dairy products (which can be as high as 20 per cent) will be removed within four to 11 years.

- With the elimination of tariffs on sheep meat, ChAFTA positions Australian farmers to further build trade and increase profitability. Tariffs on sheep meat of 12 to 23 per cent will be removed over eight years.

- Changing consumption habits and Australia’s reputation for high-quality produce also provide great opportunities in the processed food sector. Tariffs across a range of processed foods including fruit juice and honey will be removed.

- Under ChAFTA, all tariffs on horticultural products, which ranged up to 30% will be eliminated over four years.

- ChAFTA will create a huge opportunity for Australian seafood in the Chinese market. Since the China -New Zealand Free Trade Agreement came into force, China’s imports of seafood from New Zealand have almost quadrupled (to $338 million).

- Australia’s trade to China in barley and sorghum is significant and growing rapidly. In 2013, barley exports were worth $548 million, up more than 75 per cent since 2008 while sorghum exports were worth $264 million. There is an immediate elimination of the three per cent tariff on barley.

- Tariffs of up to 20 per cent on pork eliminated within four years.

- The 14 per cent tariff on Australia’s $217 million worth of wine exports will be removed within four years.

ChAFTA provides Australia with an advantage over our major agricultural competitors, including the United States, Canada and the European Union. It also counters the advantage Chile and New Zealand currently enjoy through their FTAs with China reached in 2006 and 2008.

Quentin Stewart of Wiley explains “this is big news and will surely result in the Australian Dairy sector becoming more competitive in the Chinese market. This should translate into increased sales and therefore expanding production over time as the tariffs are lifted. It is interesting that the China/New Zealand FTA has protections in place to protect local industries against increased competition, while the Australia/China FTA seems to rely on a longer phase-in period. With extensive dairy experience within its ranks, Wiley will be well poised to assist Australian dairy manufacturers increase capacity over the coming years to meet the projected demand. “

Tariffs on Australian dairy exports will be phased out over nine years, and the 15 per cent tariff on infant milk formula will be phased out over four years.

Chairman of the Australian Dairy Industry Council, Noel Campbell says the industry is already celebrating. "In the swings and round-about of the whole thing, with respect to looking at tariffs and safeguards, we believe that we got we’ve asked for," he said.

"With respect to some of the tariffs, I think the longevity of them is still quite long but overall, we’re very pleased."

Beef tariffs of between 12 and 25 per cent will be phased out over nine years. Australia’s beef exports to China are currently worth $722 million.

Wiley’s Michael Matthewson comments, “with the removal of red meat related tariffs over the next 5 or so years, a new level of economic return will drive the profitability of the Australian red meat industry in ways we are yet to fully realise. The world red meat and associated markets are quickly evolving to a new level and with China as an already key customer able to provide further commercial advantage for our products the only way from here now is up. Traditionally we have pushed a majority of our products to either the US or Japan. China now provides a true third market dynamic, and that is exciting!!”

In the most recent 2013 full calendar year, Australia’s exports to China included 155,000 tonnes of beef; 97,000t of sheep meat; 4700t of goat meat; 8000t of offal; 66,500 head of live cattle (predominantly dairy cows) and 3472 live sheep. In total that represented an export return of $1.3 billion. China is also a significant market for Australian co-products, with the combined value of offals, hides, sheepskins, tallow, meat & bone meal and pet food exports worth more than $1 billion.

“The key with this is not just what China has taken in value and volume but it is what it has been able to take from other markets,” Meat & Livestock Australia China region manager Andrew Simpson explains.

“So at last we have a third leg on the stool that is able to keep the other markets honest. And that is a value in China that we should all understand.” Mr Simpson said

“There is so much opportunity sitting here for Australian service industries, manufacturers, resources and energy and agriculture, education, you name it,” Trade Minister Andrew Robb told ABC radio.

China-Australia Free Trade Agreement

Australian dairy to go one better than New Zealand’s free trade deal with China

Hunter vignerons welcome China free trade deal

Australia-China Free Trade Agreement negotiations

China FTA countdown: Zero beef tariff over eight years looks likely

What does the China – Australia Free Trade Agreement (ChAFTA) mean for Food Manufacturers? http://t.co/W01PVRuut5 #ChAFTA

— Wiley (@Wileytalk) November 17, 2014